Airlines are Wack

Mergers, prices, and hubs

A few weeks ago, I flew from Miami to DC and back on United Airlines.1 It was a strange and exciting experience to be back in an airplane. While sitting around the terminal, my wife and I discussed two things: why are there are so few airlines in the US and where their hubs are.

Mergers and Falling Prices

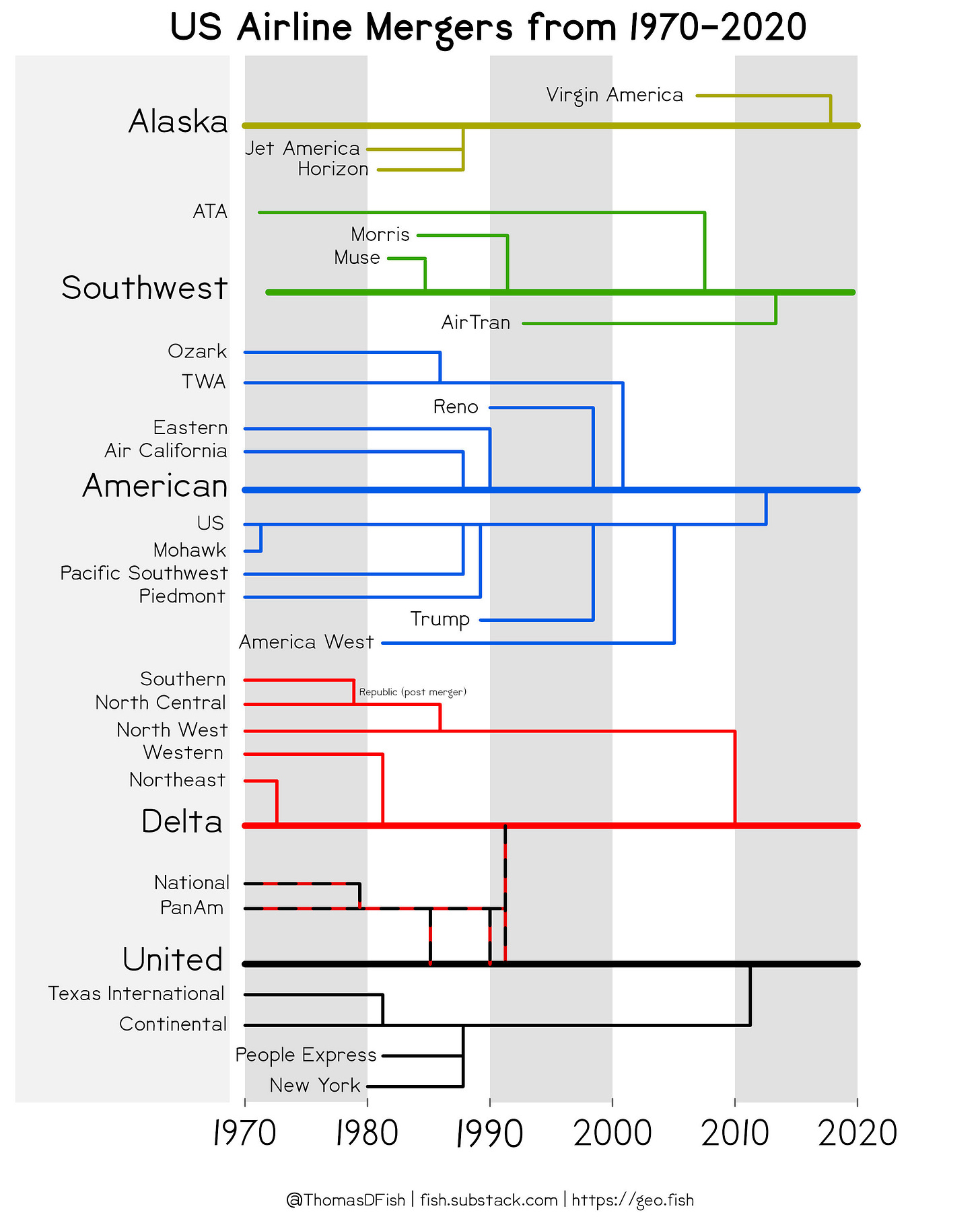

The chart above shows how the 5 largest US-based airlines (American, Delta, Southwest, United and Alaska) came to be. You can see that mergers have happened in each decade. The last big round of mergers happened in the 2010s when each of the five merged with or acquired a large competitor.

Alaska with Virgin America (2018)

Southwest with AirTran (2014)

American with US (2015)

Delta with Northwest (2010)

United with Continental (2012)

You would think that all these mergers would be bad for consumers. A smaller pool of companies fighting for about the same number of travelers is a recipe for rising prices if I remember my High School economics class correctly. The data shows the exact opposite.2

If you normalize for inflation, the price of an airline ticket has almost halved since the peak in 2001. If you go back further, the price of a round-trip ticket was almost $800 in 1980.3

This fact blows my mind because I have some strong anti-merger priors. Consolidation like what can be seen in the airline industry has happened across the economy from oil to pharma, to meat and defense contractors. I am very skeptical that having 3 to 6 too big to fail firms in each industry is better for consumers than a patchwork of choices. This seems to be the place where consumers are the winners, not corporations who are increasing prices post-merger.

I think the explanation for falling prices has to do with the Walmart and Amazon business model. Like both retailers, the business model in the airline industry involves having the lowest prices with the thinnest profit margins possible. Many consumers are going to compare prices and pick the best one. People put up with Spirit Airlines due to the low cost despite their reputation. The money in an airline is now made in the volume of seats filled each day instead of the profit margin on each seat. This is only a viable business model when you are filling lots of planes each day. The mergers make sense because they allow the large airlines to fly additional flights on additional routes to hit the necessary volume of flights to compete.

Hubs

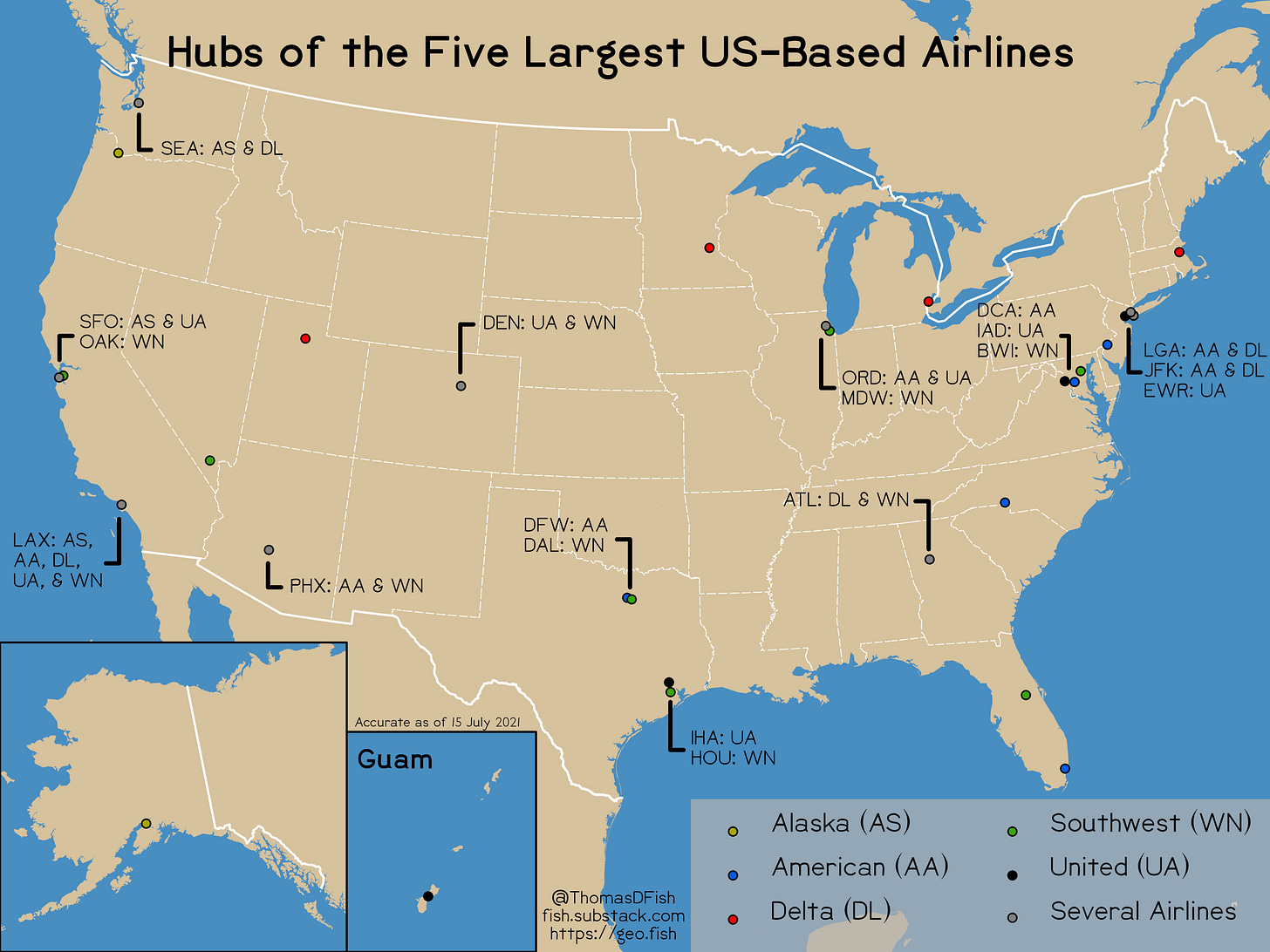

The mergers over the past 50 years explains the hubs that we have today. For example, before the merger with Northwest Airlines in 2010, Delta operated hubs in Atlanta, Cincinnati, Salt Lake City, and New York City. The hubs in Minneapolis-St. Paul and Detroit came to Delta as a part of their merger with Northwest.

The same can be said about American who inherited hubs at Philadelphia, Charlotte, and Washington-National from US Airways. This is why airlines have hubs that are so close together or in places that might not make sense if you were laying out hubs for a big national airline from first principles.

One of the interesting things is how the hubs, well hub-like focus cities, for Southwest are laid out.4 You can see Southwest’s preference for secondary lower-cost airports in their choices of Chicago-Midway, Dallas-Love Field, Houston-Hobby, and Baltimore-Washington over the larger Chicago-O'Hare, Dallas-Fort Worth, Houston-Intercontinental and Washington-Dulles. You can also see their point-to-point business model in the choices of vacation destinations such as Los Vegas and Orlando as hubs. People want to go there, it makes sense to use those places as your hub.

Support

If you want to support Maps for the Getaway, I am selling posters of the maps and graphics that I have made for this newsletter on Redbubble. If there is something you liked seeing on here, it might look good on your wall or on your laptop as a sticker.

My wife and I drove to South Florida, flew to DC, flew to South Florida, and drove back to DC in the span of two weeks like crazy people.

The stata code for this graph is

graph twoway line InflationAdjustedAirfare Year, scheme(exponentsmag) title("Average Domestic Air Fare") r2title("(2021 Dollars)") yscale(range(200 550)) ylabel(250 300 350 400 450 500)

The Exponents Mag style can be found here on github.

Derek Thompson’s 2013 article “How Airline Ticket Prices Fell 50 Percent in 30 Years (And Why Nobody Noticed)” has graphs in 2011 dollars. The peak cost in 1980 looks like ~$610. Using the CPI Inflation Calculator, that is $752.58 in 2021 dollars.

I am ignoring the opinion of Southwest who officially “has no hubs” and are calling them hubs because in 2021 they look and act like hubs